The failure rate for startup clinical research organizations (CROs) is significantly high, with a general estimate of 90% failing eventually. A substantial portion, around 60%, may fail within the first five years. This is attributed to a variety of factors, including the high costs and risks associated with clinical trials, the long timelines for drug development, and the need for significant investment and expertise.

CRO’s support more than 50% of commercial trials that are carried out globally today. In 2024, this equated to a value of $59.8 Billion. This is predicted to grow to $118.2 Billion by 2034. This is currently dominated by Oncology research – at over 54% share.

For many years we have heard discussions on transformative CRO companies emerging that shake up the industry. Despite significant funding, few have yet translated their ambitions into meaningful market impact.So why is this such a difficult marketplace to develop into?

This blog attempts to describe what these companies are often attempting to do, and to propose reasons for their potential failures.

Why a new CRO model?

The model that CRO’s have followed has not changed significantly for 20+ years. From a technology perspective, the last significant shift was a switch from paper Case Report Forms to electronic forms through the application of Electronic Data Capture (EDC) in the early 2000’s.

Prior to that Sponsors operated with centralized data entry services working against a Clinical Data Management system (CDMS).

Advances in technology since have tended to be additive rather than transformative – the same work is being largely carried out, but technology is added on-top often creating additional burdens for stakeholders. Monitors continue to visit sites. Patient recruitment continues to be delayed. Timelines are not reducing. Costs are escalating.

From a technology standpoint, I have some personal experience. In 2012, I created an all-in-one clinical research platform where sponsors, CROs, sites, and patients could collaborate on clinical trials. Unfortunately, there weren’t sufficient potential clients for our model. Our product was designed to eliminate silos—but our potential client base was built around them.

We had some success with small biotech companies that were still unified, and we had success in selling single functions – Patient Recruitment for example – but overall, it was difficult to sell. It ultimately failed because the market for a complete platform just wasn’t there.

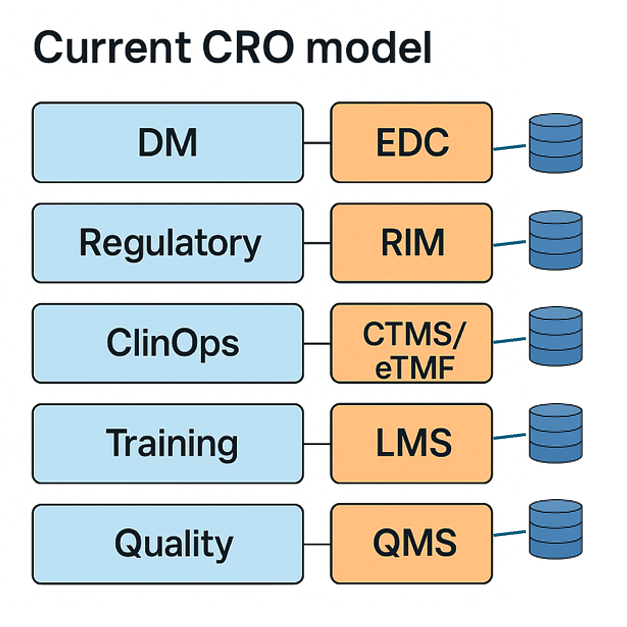

PharmBio and CRO companies are formed of silo’d entities with their own systems and data. Successful technology vendors have become savy to this and deliberately structure their products to fit these silos. Today, most PharmaBio and CRO organisations will use 6 or more independent products for each clinical trial. The limited levels of consistency and connectivity between these technologies impact performance.

Breaking pre-existing norms

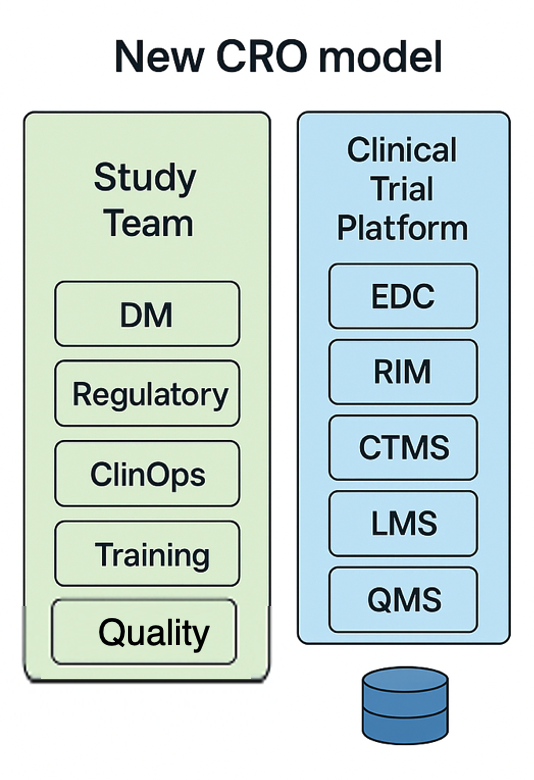

Of course, one way to break this cycle of silo organisations and silo technology is for a new breed of CRO to emerge that builds both the organisation and technology platform in a fully connected, optimised fashion. In this way, they are not bound by the silo tech available on the marketplace or by old models for trial execution.

They are free to create a new type of clinical research platform – from the ground up – that avoids the silo limitations. This achieves;

- transparency through near real-time data sharing and visibility

- Takes away the needless transcriptions.

- Avoids manual reconciliation.

- Optimising the clinical trial lifecycle.

- Models resources against an optimal way of working and not bound by the tradition of ‘we have always done it this way’.

On paper, this sounds attractive. Smaller BioTechs in particular that have found the prevailing CRO model too inflexible will be open to vendors offering a new approach. Even progressive big pharma companies that aim to be disruptive and are able to pivot their methods may be interested.

As of 2025, we have 2 major CRO Vendor startups taking slightly different approaches;

- BioTech-oriented CRO entrant (funds raised between 2020 ➡️ 2022) and

- Tech-driven CRO entrant, (Funds raised between 2021 ➡️ 2025)

Opportunities for Change

With the right steps taken, organisations that can combine modern clinical operation management and work methods together with re-architecting technologies supporting these methods, will be able to run faster, more efficient clinical trials. Agile methods will enable more rapid decision making leading to early informed responses and pivots reducing the overall timelines for projects and programs.

The Challenges

Technology

From my experience it will take approximately 4-6 years to build a complete clinical research platform suitable for running clinical trials. This assumes a team with deep prior knowledge of the functional areas (EDC, eCOA, CTMS, eTMF etc). For in-experienced teams, that will be 6-10 years, if at all.

No organisation today can run a viable clinical trial without leveraging a validated set of software products. To operate a CRO safely and effectively, you either have to license in systems, or, wait the 4+ years for your platform to be fit for purpose. During this period operating with sub-standard technology is at best inefficient. At worst, it presents avoidable risks to trial integrity and patient safety.

eClinical software is rarely written correctly first time. A common mistake made is for investors to seek experienced execs from ‘big tech’ and then expect them to morph quickly into experienced eClinical solution developers. This rarely occurs. Early development often serves more as an expensive learning curve than a foundation—most of it is eventually discarded once the team gains the domain-specific insight required to build viable products.

The timeframes obviously raise the question of buy versus build. Is it viable to create an wholly new platform and be the sole consumer of that product? I am not sure. Software companies write software. CRO’s execute clinical trials. Not many firms have successfully combined these and created sustainably software and run clinical trials. Parexel / Perceptive were the only company with limited success until their aging best of breed tech solutions reached end-of-life.

Timelines

Clinical trials take a long time. The average duration of a Phase 3 clinical trial in 2024 was 3.25 years. The average drug research program duration is 9.2 years. This means that it will be a minimum of 10 years before a startup CRO might lay a claim to have successfully completed a drug research program. Of course, it is longer than that as different CRO’s support different phases of studies.

What it boils down to though is that the development of a CRO takes many many years if performed as a single entity (not through acquisition.) Credibility demands demonstrable experience. Gambling a research program, or even a clinical trial with a startup CRO can be considered a major risk that may be vetoed by any PharmaBio investors. Getting off the ground takes many years.

Acquisition Challenges

Not only does it take years to develop a eClinical platform, it also takes years to develop the People, Processes and Technology to function effectively in support of a clinical trial. Following a future acquisition model might shortcut the time to experience and reach, but the negative impact on client engagements and quality can be detrimental. A CRO that is acquired will be running multi-year studies on alternative technologies – shifting tech mid study is impossible.

Procurement Processes

The selection processes for CROs have developed over 30 years. A CRO vendor must be prepared to fully tick all of the required boxes in order to make it onto a short list. Of the selection process, technology is a tiny factor – in my experience 15 minutes out of a 2.5hrs bid defence meeting are spent reviewing technology that a CRO will utilise. The only time that technology discussions are extended is when the technology offered is not known or established. Unknown or lesser known eClinical technologies are general seen as increased risk to the sponsor. CRO’s without the depth of quality backed functional experience will struggle to succeed over established companies.

Regulatory Hurdles

If you are running clinical trials in multiple countries, you need experienced resources in each country you operate in. Experience takes time. Overheads are therefore high per country. Patient recruitment is often dependent on reaching an untapped pool of patient candidates. Not being able to operate in a country that has such candidates can be a block to satisfying recruitment targets versus the competition.

Skills and Advice

For CROs aiming to disrupt through technology, success depends on assembling teams that can strike a delicate balance: the freedom to innovate alongside the wisdom to avoid repeating past mistakes.

Experience in building and scaling validated systems for clinical research—EDC, CTMS, eTMF, and others—is not just useful, it’s essential. Too often, technology-led ventures underestimate the specialised knowledge required to deliver compliant, fit-for-purpose clinical trial platforms.

The most effective teams blend creative thinkers who can question legacy models with domain experts who understand the practical realities of running regulated trials. Without both, there’s a risk of building beautiful solutions that simply don’t fit the constraints of real-world trials.

Conclusion: Disruption, But at What Pace?

There’s no doubt the clinical research industry is overdue for change. The desire to streamline trial execution, reduce costs, and improve access is shared by sponsors, CROs, regulators, and patients alike. And with advances in AI, real-world data, and interoperable platforms, the technology to support that change is closer than ever.

But transforming how trials are run isn’t just a technical challenge. It’s operational, regulatory and cultural. The reality is that clinical research remains an industry where experience matters, credibility takes years to build, and new entrants must navigate not only the complexity of drug development but also the inertia of established procurement, oversight, and compliance frameworks.

For startups aiming to build the next-generation CRO from scratch, this means a long road ahead—one that rewards patience, partnerships, and pragmatism. Innovation is welcome. But it must be married with a grounded understanding of what makes trials succeed today if we’re to change how they succeed tomorrow.

Discover more from ClinFlo Consulting

Subscribe to get the latest posts sent to your email.

Doug,

We should reconnect. Our team at UNIPH.io has built the platform that has been used successfully to capture, display, report and deliver all the clinical data needed for clinical trials. We are a small company looking for the right fit with a CRO or a tech provider who is reading for a modern upgrade. Unfortunately we haven’t met them yet. The future is here from the technology perspective, but the industry is slow to accept the fact that we have what they need.

Thanks Donna for the info. We should speak. I will reach out to you.